Running YouTube Ads in India in 2025 is no longer about just “getting views.” It’s where purchase decisions are made. With over 491 million Indians reachable on the platform (Meltwater, 2025), YouTube is now bigger than TV across urban households — and it’s where your next customer is already searching, comparing, and buying.

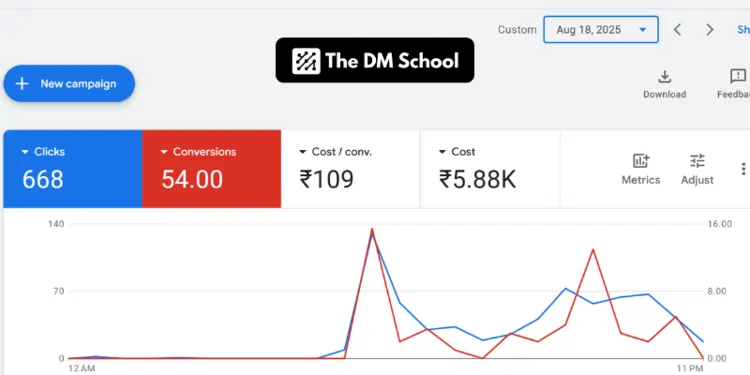

Yet, most businesses still waste lakhs testing random campaigns without a roadmap. At The DM School, we’ve seen the opposite happen: Indian brands that follow a structured YouTube system scale faster, spend less per lead, and build authority in their niche.

This guide is your 2025 playbook — from ad formats and budgets to mobile vs. CTV ROI and a 90-day launch plan. By the end, you’ll know exactly how to turn YouTube into a growth engine for your business.

Why YouTube Ads Rule in India: Reach, Growth & ROI

YouTube Ads in India are no longer optional in 2025 — they are the backbone of digital visibility. With over 491 million Indians reachable on the platform (Meltwater, 2025), YouTube has overtaken television as the most influential channel for discovery and brand recall.

The real power lies in intent. When users watch, search, or compare products on YouTube, they are closer to purchase than on any other platform. This makes ads not just about impressions, but about qualified buyers who are ready to engage.

At YouTube Ads Advertising Services, we’ve seen Indian SMBs grow faster when they put YouTube at the center of their funnel. And with formats like Shorts exploding, your message can spread across demographics at record speed.

- India has 491M+ reachable users via YouTube ads (Meltwater, 2025).

- YouTube reaches more households than TV in urban India.

- 87% of Indian consumers discovered a new brand on YouTube (Google, 2025).

For proof, check The DM School Review: YouTube Ads Results to see how structured campaigns deliver leads at scale.

Best YouTube Ad Formats for Indian Marketers

YouTube Ads in India come in different shapes depending on your goal — lead generation, awareness, or brand authority. Picking the wrong format can burn budgets; picking the right one can 10x your ROI.

Here’s a breakdown of the formats you must know in 2025, with examples from Indian campaigns:

- Skippable In-Stream Ads – Appear before or during videos; you pay only if a viewer watches 30 seconds or clicks.

Example: An EdTech brand ran skippable ads before exam-prep videos, generating 12,700 leads in 60 days at low CPL (The DM School case study). - Non-Skippable In-Stream Ads – 15–20 sec ads that viewers must watch.

Example: A real estate client used these during cricket live streams to ensure high brand recall in under 20 seconds. - YouTube Shorts Ads – Native vertical ads in Shorts feed. In 2024, Indian viewers crossed 1 trillion Shorts views (e4m, 2024).

Example: A D2C skincare startup launched Shorts ads during festive season sales and saw a 40% uplift in website visits. - Masthead Ads – Premium placement on the YouTube homepage for 24 hours.

Example: A mobile phone launch gained 8M+ homepage impressions in a single day using Masthead ads. - Connected TV (CTV) Ads – Run on smart TVs with premium targeting.

Example: Kia India’s CTV campaign drove 10× CTR and 3.6× conversions compared to mobile ads (Think with Google, 2024).

Most SMBs start with YouTube Ads Services for Indian Brands to test in-stream and Shorts. Larger enterprises combine Masthead + CTV for premium reach.

To see how this strategy is applied, check YouTube Marketing Company India insights tailored for local businesses.

What Works vs What Fails in YouTube India Ads

YouTube Ads in India reward advertisers who understand local behavior. The difference between campaigns that win and those that flop often comes down to execution. Below is a clear Do vs Don’t table with real examples from Indian brands.

| ✅ Do This | ❌ Don’t Do This |

|---|---|

| Hook in the first 5 seconds with problem-solution messaging. Example: An EdTech brand doubled CTR by opening with “Struggling to clear NEET?” instead of generic intros. |

Wasting first 10 seconds on logos or animations — audiences skip instantly. |

| Use regional language targeting (Hindi, Tamil, Telugu). Example: A D2C brand saw 58% higher CTR using Tamil ads vs English-only. |

Running only English creatives for pan-India audiences — alienates Tier 2/3 markets. |

| Integrate call-to-action overlays with WhatsApp or site links. Example: A coaching institute added WhatsApp CTA and reduced lead response time by 40%. |

Expecting viewers to “search later” without giving a direct action. |

| Test multiple creatives weekly and scale winners. Example: The DM School ran 20+ creative tests and scaled top 3, cutting CPL to ₹51. |

Running one ad creative for months without iteration — fatigue kills performance. |

Following these practices can save lakhs in wasted spend. For deeper strategies, explore our YouTube Ads Expert insights or study a YouTube Ads Leads Case Study where 12,700 leads were generated in India.

YouTube Ads Channels: Mobile vs CTV – Which Wins ROI?

YouTube Ads in India deliver results across both mobile and Connected TV (CTV), but the costs and outcomes differ sharply. In 2025, Indian businesses must weigh scale against premium engagement before allocating budgets.

Here’s a direct comparison of Mobile vs CTV campaigns:

| Channel | Avg CPM (₹) | Audience | Engagement | ROI Potential |

|---|---|---|---|---|

| Mobile Ads | ₹30–₹70 | Mass audiences across Tier 1–3 cities | High volume, shorter attention | Great for lead generation, low CPL |

| Connected TV (CTV) Ads | ₹120–₹250 | Premium households & decision makers | Longer watch time, immersive | 2–3× stronger brand recall, premium conversions |

Mini Cost Snapshot (India 2025):

| Channel | Typical Monthly Budget | Expected ROI | Best For |

|---|---|---|---|

| Mobile Ads | ₹25K – ₹2L+ | High lead volume, lower CPL | SMBs, startups, e-commerce |

| CTV Ads | ₹50K – ₹5L+ | Premium conversions, 2–3× recall | Real estate, auto, BFSI |

Example: Kia India’s CTV campaign achieved 10× CTR and 3.6× higher conversions compared to mobile campaigns (Think with Google, 2024).

To go deeper, explore our YouTube Ads Customer Acquisition insights or get a YouTube Ads Audit to find the right balance for your campaigns.

Plan Your 2025 YouTube Ads Flywheel™

YouTube Ads in India don’t just create one-off leads — when structured correctly, they fuel a Growth Flywheel™ where traffic, trust, and transactions build on each other. The goal is to design campaigns that compound momentum month after month.

Here’s how the Flywheel works for Indian businesses:

- Traffic: In-stream + Shorts ads bring massive reach across Tier 1–3 cities.

- Trust: CTV & Masthead campaigns build authority and premium brand recall.

- Transactions: Retargeting + call-to-action overlays convert viewers into paying customers.

Example: According to Google Marketing Live India (2025), 87% of Indian consumers discovered a new brand through YouTube. At YouTube Lead Generation Agency India, we structure funnels where awareness ads feed into remarketing sequences and close with WhatsApp + email automation.

For a full framework, study The DM School Growth Marketing Flywheel Framework that has powered hundreds of campaigns across EdTech, real estate, and D2C brands.

Next 90-Day Play: Launch YouTube Ads in India Now

YouTube Ads in India work best when you launch in tight sprints, review data weekly, and scale winners. Use this 90-day execution plan to go from zero to predictable ROI.

- Days 1–30: Foundation & First Wins

- Define one ICP, one offer, one CTA (WhatsApp/site lead form).

- Produce 5–7 short video variants (hooks in first 5 seconds).

- Launch Skippable + Shorts with modest budgets (₹25K–₹50K).

- Measure CTR, view rate, and first 100 leads’ CPL.

- Days 31–60: Optimise & Add Retargeting

- Kill bottom 50% creatives; double spend on top 2–3.

- Enable remarketing (viewers, site visitors, engaged users).

- Test language variants (Hindi/Tamil/Telugu) and 2 new hooks.

- Aim for CPL stability ±15% week over week.

- Days 61–90: Scale & Premium Inventory

- Add CTV for premium reach (product launches, high-ticket).

- Introduce Masthead for 24-hour bursts (festive/events).

- Expand geos; build a weekly creative pipeline (3 new ads/week).

- Lock a monthly review rhythm: creatives → audiences → budgets.

Action Steps (Start Today):

- List your top 3 hooks and record two 20–30s videos per hook.

- Set up conversions and remarketing audiences before launch.

- Schedule a weekly kill/scale meeting (30 minutes, same day/time).

Strategic Benefits:

- Faster feedback loops → lower CPL within 2–4 weeks.

- Creative velocity prevents fatigue and protects ROI.

- Layered channels (Shorts + In-stream + CTV) compound brand lift.

Fact to track: Indian brands that iterate creatives weekly maintain stable CPLs while scaling budgets — align reviews to your 7-day performance window.

Want expert eyes on your plan? Book a Free Strategy Call. If you’re in education, see our playbook for YouTube Ads for EdTech in India.

Mid-Article Quick Win Playbook (7-Day Sprint)

YouTube Ads in India respond fast when you tighten targeting and multiply hooks. Run this one-week sprint to get immediate traction.

- Pick 1 ICP + 1 Offer: Define one audience and one clear conversion (WhatsApp or lead form).

- Create 6 Hook Variations: Record two 20–30s videos each for problem, proof, and promise angles.

- Launch Skippable + Shorts: Split ₹10K–₹15K test budget across the six creatives.

- Set Up Remarketing: Viewers, site visitors, and engaged users for a 7-day window.

- Daily Kill/Scale: Pause bottom 50% CTR/view rate; double budget on top two ads.

Pro move: Start with in-stream for reach, layer Shorts for frequency. Then add remarketing on Day 4.

Need help structuring the first test? See YouTube Ads Services for Indian Brands or Book a Free Strategy Call.

Your 7-Day YouTube Ads Sprint

YouTube Ads in India respond quickly when you tighten targeting and multiply hooks. Use this one-week sprint to get fast, clean data and first wins.

- Pick 1 ICP + 1 Offer: One audience. One clear conversion (WhatsApp or lead form).

- Create 6 Hook Variations: Record two 20–30s videos each for problem, proof, and promise angles.

- Launch Skippable + Shorts: Split ₹10K–₹15K test budget across the six creatives.

- Set Up Remarketing: Viewers, site visitors, and engaged users for a 7-day window.

- Daily Kill/Scale: Pause bottom 50% CTR/view rate. Double budget on top two ads.

Smart Shortcut: Start with in-stream for reach, layer Shorts for frequency. Add remarketing on Day 4.

Need help structuring the first test? See YouTube Ads Services for Indian Brands or Book a Free Strategy Call.

Reality Check: Common YouTube Ads Objections in India

YouTube Ads in India can fail if you treat them like TV spots or ignore creative velocity. Here’s what to fix before scaling.

- “It’s too expensive.” Mobile CPMs often sit at ₹30–₹70; start small, prove CPL, then layer CTV.

- “Our audience won’t watch.” Hooks in the first 5 seconds + language localization beat drop-offs.

- “We tried and it didn’t work.” Most failed tests ran one creative for weeks; rotate 6–9 variants.

- “Lead quality is poor.” Add remarketing + WhatsApp CTA overlays; filter with specific copy.

Action Steps: Audit the last 14 days, kill bottom 50% creatives, ship 3 new hooks this week, and enable remarketing before raising budgets.

If you’re unsure where the leak is, run a quick YouTube Ads Audit or review our YouTube Ads Leads Case Study.

Conclusion: Your Next 90 Days with YouTube Ads in India

YouTube Ads in India have moved from “optional” to “essential” in 2025. With 491M+ reachable users, Shorts dominating attention, and CTV unlocking premium audiences, the question is no longer if you should advertise — but how fast you can build a winning system.

By now you’ve seen the playbook: formats, costs, ROI tables, growth flywheel, and a 90-day plan. The difference between wasting lakhs and scaling profitably is discipline — testing creatives, running remarketing, and tracking CPL week by week.

Six months from now, you could look back at this moment as the point where you turned YouTube into your #1 growth channel. Or you could keep guessing, while competitors capture attention on the platform your customers already trust.

Ready to Start?

If you want a proven roadmap for YouTube Ads in India, here’s the next step:

- Who it’s for: Indian SMBs, startups, EdTech, real estate, D2C brands.

- Next step: Book a Free Strategy Call with our team.

- Expected outcome: A custom 90-day YouTube Ads plan designed to lower CPL and increase conversions.

Still curious how this works in your industry? Start with our YouTube Ads for EdTech in India insights or browse our YouTube Ads Results Review.

FAQs: YouTube Ads in India (2025)

What is the ideal budget to start YouTube ads in India?

Begin with ₹25K–₹50K for two weeks. Split across Skippable and Shorts, run 6–9 creatives, and scale winners. If CPL stabilizes, increase 20–30% weekly. For help, Book a Free Strategy Call.

How fast can I see results from YouTube ads?

First signals arrive in 3–5 days; reliable CPL trends in 10–14 days. Expect stronger ROI by week 3–4 with kill/scale discipline and remarketing enabled.

Which formats work best for Indian SMBs?

Skippable In-stream for reach and Shorts for frequency. Add CTV only after proving CPL. See our service overview: YouTube Ads Advertising Services.

What targeting works in Tier 2/3 cities?

Language localization (Hindi/Tamil/Telugu), interest + custom intent (keywords, competitor channels), and remarketing. Keep creatives local: voiceover, examples, and pricing in Rupees.

How do I lower CPL on YouTube in India?

Test hooks weekly, use Shorts for volume, tighten geos, and add WhatsApp CTA overlays. Kill bottom 50% creatives every 7 days and double the top two.

Is CTV worth it for Indian brands?

Yes for premium categories (real estate, auto, BFSI). CPMs are higher, but recall and trust improve. Use after mobile wins to amplify launches and brand authority.

“YouTube Ads in India: Complete Guide (2025)” — what’s the core takeaway?

Prove CPL on Skippable + Shorts, then layer CTV. Run weekly creative cycles, always-on remarketing, and a 90-day plan. This is the fastest path to reliable ROI.

Can YouTube generate quality leads for courses in India?

Yes. Intent video + remarketing reliably drives enrollments when funnels are tight. See our results: YouTube Ads Results Review.

Where can I find packages for YouTube advertising in India?

Review formats, deliverables, and inclusions here: YouTube Ads Services for Indian Brands. Start lean, then scale with data.

How do I implement the “YouTube Ads in India: Complete Guide (2025)” in my company?

Follow the 7-day sprint, 90-day plan, and our mobile-first → CTV path. If you want hands-on help, Book a Free Strategy Call.