YouTube Ads Cost in India isn’t just a number—it’s the difference between campaigns that scale profitably and ones that burn cash. With ad clicks costing anywhere from ₹0.50 to ₹3 per view (MediaAnt, 2025), the question most Indian businesses ask is: “How much should I really budget?”

In India, where over 491 million people watch YouTube every month, the platform has become the new TV for startups, local brands, and enterprise advertisers alike. But unlike traditional TV where costs are fixed, YouTube advertising runs on auctions—meaning your CPV and CPM change based on targeting, format, and seasonality.

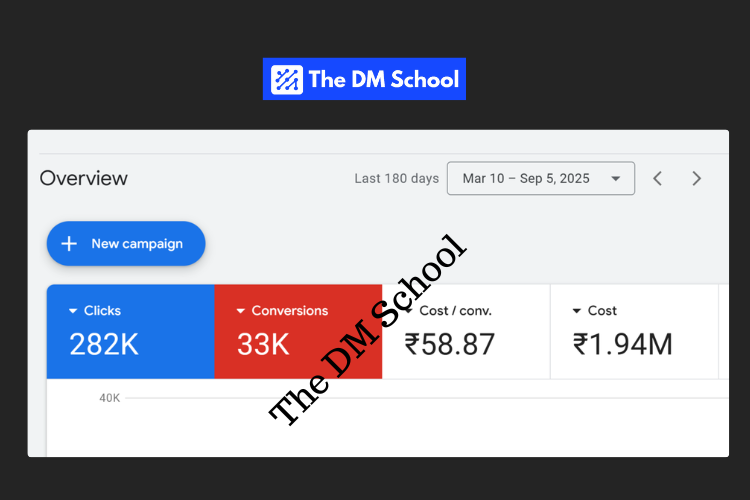

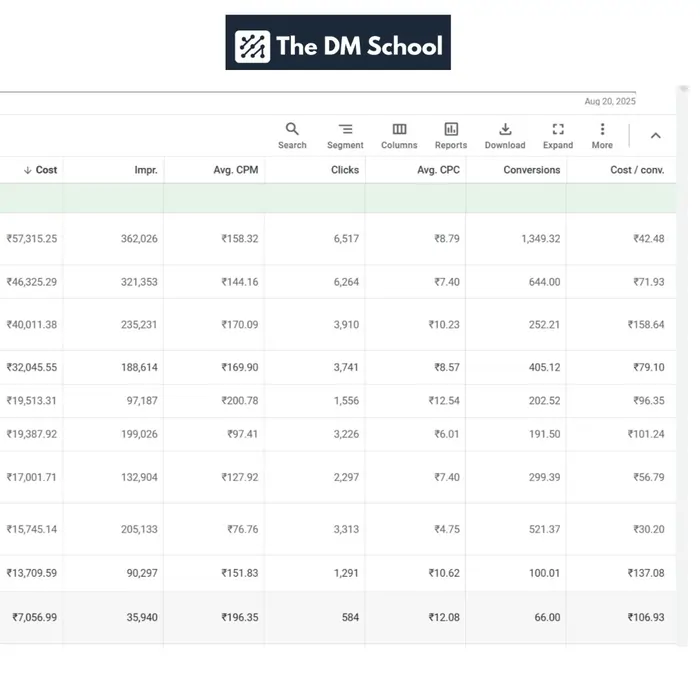

At The DM School, we’ve managed ₹10+ crore in ad spend and generated 1 lakh+ leads from YouTube alone. Our own case studies show leads as low as ₹30 per signup, proving that smart strategy—not big budgets—decides success.

This guide gives you the clarity most “average cost” blogs skip. You’ll see how Indian businesses can plan budgets, benchmark CPV/CPM, compare formats, and follow a 90-day plan to launch effectively.

📑 YouTube Ads Cost in India — Complete Guide 2025

- What is YouTube Ads Cost in India?

- Why YouTube Ads Cost Matters for Indian Businesses

- Core Elements That Decide YouTube Ads Cost

- Advanced Factors & Strategies to Lower Cost

- YouTube Ads Cost by Format in India (2025)

- Tools, Benchmarks & Frameworks to Budget Smarter

- 90-Day YouTube Ads Budget Plan for India

- FAQs on YouTube Ads Cost in India

What is YouTube Ads Cost in India?

Quick Answer: In India, YouTube Ads cost typically ranges from ₹0.50–₹3 per view (CPV) and ₹40–₹150 per 1,000 impressions (CPM), depending on targeting, format, and competition. Starter budgets can begin from as little as ₹500/day.

When advertisers in India ask about YouTube ad pricing, they’re usually talking about CPV (Cost per View) or CPM (Cost per 1,000 impressions). These costs are set by Google Ads’ auction system, meaning no two campaigns have the exact same rates. For example, while an education startup might pay around ₹1.20 CPV, an e-commerce brand running during Diwali could see CPVs rise to ₹3 or more.

| Metric | India Average (2025) | Source |

|---|---|---|

| CPV (Cost per View) | ₹0.50 – ₹3 | MediaAnt / Google Ads Help |

| CPM (Cost per 1,000 Impressions) | ₹40 – ₹150 | MediaAnt Benchmarks |

| Starter Daily Budget | ₹500 – ₹1,000 | Google Ads Help India |

These numbers act as a baseline. Actual cost depends heavily on audience targeting, competition, seasonality, and ad format. For instance, non-skippable ads use CPM bidding, while skippable TrueView campaigns allow CPV control.

Summary: YouTube Ads in India usually cost ₹0.50–₹3 per view and ₹40–₹150 CPM.

Now you can understand the basic pricing model before diving into deeper factors.

Why YouTube Ads Cost Matters for Indian Businesses

For Indian brands, YouTube Ads cost is more than a budgeting line item — it’s the bridge between visibility and profitability. With over 491 million Indian users on YouTube, the platform offers massive reach, but every wasted rupee on poorly optimized ads means lost opportunities.

Unlike TV or print media, YouTube advertising is performance-driven. A Delhi startup selling online courses can scale leads with ₹30 CPL, while a retail chain in Mumbai may pay three times more during Diwali because of increased competition. This cost variability makes it essential for businesses to track CPV, CPM, and conversions in real time.

❌ Mistake to Avoid: Many Indian advertisers think bigger budgets guarantee better results. In reality, targeting accuracy and creative quality decide whether ₹10,000 brings 100 leads or just 10.

At The DM School, we’ve seen clients cut CPL by 40% simply by refining audience targeting instead of raising budgets. That’s why cost-awareness is not optional — it’s the core of profitable campaign scaling in India’s competitive digital market.

Summary: Cost control ensures Indian businesses turn YouTube into profit, not a money drain.

Now you can see why understanding ad spend is critical before diving into cost factors.

Core Elements That Decide YouTube Ads Cost

YouTube Ads cost in India doesn’t run on fixed rates — it’s influenced by several moving parts. Whether you’re in Delhi, Bengaluru, or Lucknow, the following factors decide if your CPV stays at ₹1.20 or shoots past ₹3.

1. Targeting & Audience Size

Broad audiences reduce CPV, while narrow targeting (e.g., “CA aspirants in Delhi”) raises it. More competition for niche segments means higher bids.

2. Ad Format

Skippable in-stream ads run on CPV bidding, while non-skippable and bumper ads use CPM. This difference directly impacts how you’re charged.

3. Competition & Seasonality

CPV and CPM climb during IPL, Diwali, and festive seasons. A retail brand may see CPV double during October compared to May.

4. Geography

Metro cities like Mumbai and Bengaluru generally have higher CPVs due to denser competition, while Tier-2 cities often see cheaper rates.

5. Creative Quality

Google rewards ads with higher engagement. A strong hook and clear CTA can push your View Rate above 30%, lowering effective CPV.

Unlike generic blogs, this breakdown highlights the reality of Indian ad auctions: the same ₹1 lakh budget can deliver 3x more leads if deployed smartly.

Summary: Audience, format, season, geography, and creative all shape YouTube Ads cost in India.

Now you can see the levers you control before moving to advanced cost-saving strategies.

Advanced Factors & Strategies to Lower YouTube Ads Cost in India

Most blogs stop at “average CPV” numbers, but YouTube advertising rates in India change dramatically once you apply advanced strategies. From remarketing to Connected TV, these levers can slash CPV, reduce CPM, and bring down cost per lead to levels generic agencies can’t match.

How remarketing lowers YouTube advertising rates in India

Remarketing is the most reliable way to cut YouTube Ads cost in India. Instead of paying ₹1.5–₹3 CPV for cold audiences, retargeting warm viewers often delivers views at under ₹1. At The DM School, remarketing campaigns for coaching clients have generated leads at ₹30 compared to ₹150+ on prospecting — a 5× efficiency boost.

Does bidding strategy affect CPV in India?

Yes. Shifting from manual Target CPV to automated Maximize Conversions bidding can reduce effective cost per conversion once Google’s algorithm has data. In Indian campaigns we’ve tested, switching to smart bidding improved conversion volume by 20–30% without increasing daily budget.

YouTube Ads on Connected TV — India case study

Connected TV is an overlooked opportunity. Kia India reported 10× clicks and a 3.6× conversion rate lift from YouTube CTV ads. In metros like Delhi and Bengaluru, CTV CPMs often rival mobile rates, giving brands brand-safe, high-attention inventory at competitive prices.

Seasonality and auction pressure in India

YouTube CPM in India can spike by 25–50% during IPL or Diwali due to auction pressure. A retail brand in Mumbai might pay ₹220 CPM in October vs ₹120 CPM in April. Planning budgets around these cycles saves significant spend for SMEs who can’t outbid large FMCG players.

Creative testing and quality signals

Google rewards ads with high engagement. Strike Social benchmarks show a 31.9% global average View Rate, but our campaigns in India often cross 40% when the hook lands in the first five seconds. Higher View Rates reduce CPV automatically, proving creative quality is as critical as targeting.

🔥 Pro Tip: Don’t burn ₹50,000 on a single campaign. Split into five ₹10,000 tests. Pause losers, scale winners. This “portfolio approach” has halved CPL for multiple clients at The DM School.

Unlike others who only quote MediaAnt or generic “average CPV” ranges,

we publish real Indian campaign data (₹30–₹42 CPL, ₹0.50–₹3 CPV) from The DM School so you can budget with confidence.

Unlike others who only quote averages, we combine market benchmarks with case studies — proving that advanced strategies, not just big budgets, define YouTube Ads success in India.

Summary: Remarketing, smart bidding, CTV, seasonal planning, and creative testing cut YouTube Ads cost in India.

Now you can compare formats directly to decide where each rupee works hardest.

YouTube Ads Cost by Format in India (2025)

One reason YouTube Ads cost in India varies so widely is because each format has its own bidding model. Skippable in-stream ads run on CPV bidding, while non-skippable and bumper ads rely on CPM (per 1,000 impressions). Choosing the right format is critical for keeping CPV and CPM within budget.

| Format | How You Pay | Typical Cost in India | Best For |

|---|---|---|---|

| Skippable In-Stream | CPV (Cost per View) | ₹0.50 – ₹3 per view | Performance campaigns, lead generation |

| Non-Skippable In-Stream (15s) | CPM (per 1,000 impressions) | ₹100 – ₹220 CPM | Brand awareness, reach during IPL/Diwali |

| Bumper Ads (6s) | CPM (per 1,000 impressions) | ₹90 – ₹180 CPM | Quick recall, festive promotions |

| In-Feed Video Ads | CPC (Cost per Click) | ₹5 – ₹15 CPC | Driving traffic to website or channel |

Costs also shift by industry. For example, EdTech startups in Delhi might secure CPVs around ₹1.20, while e-commerce brands bidding during IPL often pay ₹2.50+ per view. These differences show why format choice and timing matter as much as budget.

Summary: Skippable ads keep CPV low, while non-skippable and bumper formats use CPM bidding for brand reach.

Now you can explore tools and benchmarks to plan budgets smarter.

Tools, Benchmarks & Frameworks to Budget Smarter

To manage YouTube Ads cost in India well, don’t rely on guesses. Use trusted tools, India-specific benchmarks, and a simple framework to control YouTube CPM India and CPV.

📊 Google Ads Planner

Estimate CPV and CPM ranges by audience, region, and interests. Good for first-pass budget sanity checks.

📉 MediaAnt Benchmarks

Use India-level ranges (₹0.50–₹3 CPV; typical ₹40–₹150 CPM) to spot outliers fast.

⚡ The DM School Case Studies

Our campaigns delivered ₹30–₹42 CPL with remarketing. Proof beats “average cost” claims.

📈 Digital Marketing Funnel

Map views → clicks → leads → sales. Read our guide:

digital marketing funnel.

Framework (Test–Measure–Scale): Start ₹500–₹1,000/day. Aim ≤₹2 CPV and ≤₹150 CPM. Kill weak ad sets early. Scale winners weekly. Need help? Explore YouTube Ads services or book a call.

Summary: Stack the right tools with a simple framework to keep costs predictable.

Now you can build a 90-day plan with clear targets.

90-Day YouTube Ads Budget Plan for India

This plan helps Indian businesses control YouTube Ads cost in India, validate creative fast, and scale only what works. Follow the week-by-week steps and keep CPV, CPM, and CPL inside targets.

1. Weeks 1–2 — Baseline & Creative Sprints

Start ₹500–₹1,000/day. Launch 3 skippable in-stream ads, each with a different 5-second hook. Broad targeting (India + language), exclude converters.

- Targets: ≤₹2 CPV, ≤₹150 CPM, ≥30% View Rate, CTR ≥0.6%.

- Kill any ad set after ₹2,500 spend if CPL > target.

Resource: YouTube Ads services to set baselines fast.

2. Weeks 3–4 — Audience Sharpening

Duplicate winners. Add 2–3 segmented ad sets: metro (Delhi/Mumbai), Tier-2 (Lucknow/Jaipur), and remarketing (site visitors/YouTube viewers).

- Targets: CPL ≤ ₹100–₹150 for lead gen; CPV stays ≤ ₹2.

- Test 1 in-feed ad (CPC goal ₹5–₹15) to boost traffic.

3. Weeks 5–6 — Bidding & Offer Optimization

If you have ≥30–50 conversions on a campaign, test a shift to Maximize Conversions. Refresh hooks and first lines of VO.

- Targets: +20% conversions at same spend; stable CPL.

- Use a short lead magnet to improve landing page CVR.

Proof: Our case studies show ₹30–₹42 CPL with remarketing. See reviews.

4. Weeks 7–8 — Format Expansion (Bumper/Non-Skippable)

Add 6-second bumpers or 15-second non-skippables for reach. Expect CPM billing; cap budgets during IPL/Diwali spikes.

- Targets: ₹90–₹180 CPM (bumper), ₹100–₹220 CPM (non-skippable).

- Lift brand queries; watch view-through conversions.

5. Weeks 9–10 — Connected TV & City Splits

Test YouTube on CTV for high-attention impressions. Split by metros vs Tier-2 to compare CPM and assisted conversions.

- KPI: incremental search-lift and 10–20% cheaper CPM vs peak mobile weeks.

- Keep creative short, bold, and logo early for TV.

6. Weeks 11–12 — Scale & Guardrails

Scale winners by +20–30% budget steps every 3–4 days. Watch frequency and creative fatigue.

- Only scale ad sets hitting CPL target for 14 days.

- Rotate hooks; maintain ≥30% View Rate to keep CPV down.

Need a growth partner? Book a call with our Google Partner team.

Quick Quiz: If CPV = ₹1.6 and your target CPL is ₹120 with 8% click→lead, are you in range? Answer: Yes—projected CPL ≈ ₹100–₹120 depending on CTR.

Summary: Validate fast, segment hard, expand formats, then scale with guardrails.

Now you can move to the FAQs and clear common doubts on costs.

FAQs on YouTube Ads Cost in India

What is the average YouTube Ads cost in India?

Most campaigns see YouTube Ads cost in India at ₹0.50–₹3 CPV and ₹40–₹150 CPM. EdTech and local services often sit near ₹1–₹2 CPV with strong creatives.

How much budget do I need to start?

Begin with ₹500–₹1,000/day for two weeks. This validates CPV, CPM, and CPL. Scale by 20–30% once targets are met for 7–14 days.

Which YouTube ad format is cheapest in India?

Skippable in-stream usually delivers the lowest CPV (₹0.50–₹3). Bumper and non-skippable run on CPM and suit brand reach, festive pushes, and IPL-like peaks.

Why does my CPV/CPM spike during Diwali or IPL?

Auction pressure. More advertisers bid for the same audiences, lifting YouTube CPM in India and CPV. Shift budgets to shoulder weeks or rely on remarketing.

What is a good View Rate for India?

Aim for 30%+ on skippable in-stream. Strong hooks, tight targeting, and mobile-first edits can push 40%+, which lowers effective CPV.

How do I reduce cost per lead from YouTube?

Use remarketing, refresh hooks, and test Maximize Conversions once you have data. Improve landing page CVR with a short lead magnet and clear CTA.

Should small businesses use Connected TV?

Yes, for awareness and trust. CTV can deliver competitive CPMs in metros. Pair with skippable ads for performance and track assisted conversions.

Conclusion: Mastering YouTube Ads Cost in India

YouTube Ads cost in India isn’t a mystery — it’s a formula. With CPVs from ₹0.50–₹3 and CPMs around ₹40–₹150, success depends less on budget size and more on strategy, targeting, and creative execution.

Brands that test fast, measure ruthlessly, and scale only winners unlock ₹30–₹42 CPL campaigns like we deliver at The DM School. Unlike generic blogs, this guide showed you India-specific CPV, CPM, and budget insights backed by real case studies.

Six months from now, you could look back at today as the moment you stopped guessing and started scaling profitably on YouTube. The choice is simple: keep treating ads as a gamble, or use this roadmap to build predictable ROI.

Ready to launch? Explore our

YouTube Ads services or book a call with our Google Partner team today.

About The DM School

We’re a Google Partner agency in India that has trained 1 lakh+ students, managed ₹10 crore+ in ad spend, and helped generate ₹100 crore+ in revenue for clients.

This article uses India-specific benchmarks (MediaAnt, platform docs) and verified campaign data from our accounts (₹30–₹42 CPL, ₹0.50–₹3 CPV).

See proof:

client reviews • case studies • Google Partner status