Bharti Airtel SWOT analysis 2025 explores the strengths, weaknesses, opportunities, and threats shaping one of India’s most premium telecom operators. Airtel is not just a mobile company — it is a diversified provider of wireless, fiber broadband, DTH, enterprise connectivity, and data center services across India and Africa.

As of Q1 FY26, Airtel serves more than 605 million customers worldwide, including 436 million in India. With ARPU rising to ₹250, record broadband net adds, and EBITDA margin nearing 60% in its India business, Airtel has reinforced its leadership in profitable growth.

The company continues to push premiumization through postpaid plans, OTT content bundles, and 5G adoption. Its strategy mirrors North American carriers but adapted for India’s high-volume, price-sensitive market. This balance of affordability and premium service gives Airtel a distinct competitive edge.

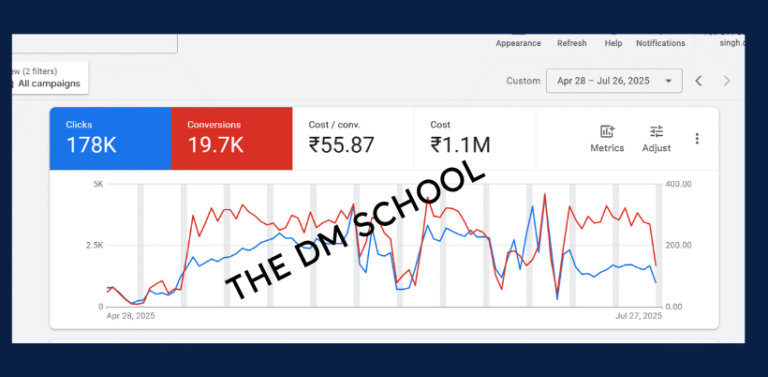

As Deepak Singh, Founder of The DM School, I bring this analysis to help business leaders and students decode Airtel’s scale, pricing discipline, Africa diversification, and digital ecosystem plays in 2025.

For deeper insights into Indian corporates and strategy frameworks, you can also explore The DM School, where we document case studies and competitive breakdowns in detail.

Strengths of Bharti Airtel

The strengths of Bharti Airtel explain why it has become India’s premium telecom brand and one of the most profitable operators in Asia. With high ARPU, expanding fiber, and Africa scale, Airtel combines financial discipline with customer stickiness in 2025.

- Premium ARPU leadership:

Airtel’s average revenue per user (ARPU) hit ₹250 in Q1 FY26, up from ₹211 last year. This is the highest among Indian operators. ARPU strength reflects Airtel’s ability to attract postpaid, 5G, and high-value customers — creating a profitable user base while peers chase volumes. - High India profitability:

Airtel India delivered an EBITDA margin of 59.5% in Q1 FY26, up nearly 600 bps YoY. Such profitability shows Airtel’s superior pricing discipline, network efficiency, and ability to pass on tariff hikes. It is rare in global telecom for margins to be this high. - Homes growth flywheel:

Airtel added a record 939k broadband customers in Q1 FY26, taking its home base to 11 million. Its Xstream Fiber footprint now spans 847 towns, with a goal of 40 million home passes. Bundled IPTV and Wi-Fi solutions improve stickiness and raise average revenue per household. - Enterprise and B2B platforms:

Through Airtel Business, the company serves India’s largest enterprises with cloud, CPaaS, cybersecurity, IoT, and connectivity. While low-margin contracts were pruned, the focus on digital platforms ensures B2B remains a sticky and expanding vertical that adds resilience beyond consumer mobility. - Africa diversification:

Airtel Africa, with 169 million customers, delivered 24.9% revenue growth (CC) in Q1 FY26 and EBITDA margin above 48%. Africa contributes both growth and diversification, reducing Airtel’s dependence on Indian cycles while unlocking mobile money and data-led opportunities. - 5G rollout and network quality:

Airtel leads with over 135 million 5G users (analyst estimate, Mar 2025). It consistently wins Opensignal awards for download speeds and reliability. Superior network experience is why Airtel captures premium subscribers willing to pay more for quality. - Prudent balance sheet:

With net debt/EBITDAaL at just 1.26x (ex-leases), Airtel enjoys financial flexibility. This conservative leverage allows continued capex on 5G, fiber, and towers without straining returns, keeping investor confidence high. - Content and bundled ecosystems:

Airtel’s single subscription bundles give users access to 25+ OTT platforms (Netflix, Sony LIV, Zee5, etc.), along with Google One and Apple Music. This not only improves ARPU but also positions Airtel as a lifestyle brand, not just a telecom provider.

🔥 Pro Tip: Airtel’s moat is not just spectrum or subscribers — it’s profitable premiumization. By converting 2G/3G users to 4G/5G, bundling OTTs, and pushing postpaid, Airtel ensures ARPU grows faster than volume, a strategy most telcos struggle to execute.

These Airtel strengths show how premium pricing, fiber expansion, and Africa diversification create resilience — similar to growth playbooks we analyzed in our HDFC Bank SWOT analysis.

Summary: Airtel strengths include premium ARPU leadership, high India profitability, rapid broadband growth, enterprise depth, Africa diversification, strong 5G rollout, prudent leverage, and sticky OTT bundles.

Weaknesses of Bharti Airtel

The weaknesses of Bharti Airtel reveal the structural challenges that limit its ability to dominate India’s telecom market despite strong ARPU and profitability. Airtel is well-managed, but telecom remains a capex-heavy, regulation-sensitive, and hyper-competitive business.

- Heavy capital expenditure burden:

Telecom is one of the most capital-intensive industries. Airtel invests billions each year on spectrum, 5G rollouts, and fiber expansion. This continuous capex cycle compresses free cash flow and raises pressure on returns compared to asset-light industries. - Competitive pressure from Jio:

Reliance Jio continues to be the largest wireless operator with over 470M subscribers and aggressive pricing. Airtel leads on ARPU, but Jio’s scale advantage and bundled ecosystem (JioCinema, JioSaavn, JioFiber) limit Airtel’s ability to fully dominate. - DTH business decline:

Airtel Digital TV revenue was flat at ₹763 crore in Q1 FY26 with limited growth. As Indian consumers migrate to OTT platforms, the DTH segment faces structural decline, which drags overall media revenue growth. - Enterprise growth slowdown:

Airtel Business, once a strong differentiator, reported a 7.7% YoY decline in revenue due to pruning of low-margin contracts. Though strategic, this highlights vulnerability in capturing enterprise digital transformation growth. - High Africa exposure risks:

Airtel Africa contributes ~169M subscribers and strong margins, but also exposes Airtel to forex volatility, inflation, and regulatory instability in emerging markets like Nigeria, Kenya, and Tanzania. - Regulatory and policy uncertainty:

Airtel’s future plays in satellite broadband (via OneWeb stake) face policy risks, including potential subscriber caps or spectrum regulations. Any unfavorable policy could restrict expansion in India’s upcoming satcom market. - ARPU growth ceiling risk:

At ₹250 ARPU, Airtel already leads the market. While further tariff hikes are possible, India’s price-sensitive consumer base creates a natural ceiling, limiting infinite ARPU expansion compared to developed markets.

📊 Airtel vs Jio vs Vi (Q1 FY26 snapshot)

- Bharti Airtel: 436M subscribers | ARPU ₹250 | EBITDA margin ~59.5%

- Reliance Jio: 470M+ subscribers | ARPU ~₹181 | EBITDA margin ~52%

- Vodafone Idea (Vi): 220M subscribers | ARPU ~₹145 | Negative margins, heavy debt

Airtel outperforms on ARPU and margins, but Jio dominates on sheer subscriber scale while Vi struggles for survival.

These Airtel weaknesses show how capital intensity, Jio’s scale, DTH decline, and regulatory risks remain major hurdles — a sharp contrast to sectors like banking, as seen in our ICICI Bank SWOT analysis.

Summary: Weaknesses include high capex burden, competitive pressure from Jio, DTH decline, enterprise slowdown, Africa exposure risks, regulatory uncertainty, and ARPU ceiling.

Opportunities for Bharti Airtel

The opportunities of Bharti Airtel lie in monetizing 5G adoption, scaling home broadband, strengthening enterprise solutions, and leveraging its Africa footprint. With India’s data consumption surging and new technologies opening up, Airtel can compound its growth in 2025 and beyond.

- 5G monetization:

Airtel has already crossed 135M 5G users (estimate, Mar 2025). By offering premium speeds, bundling OTT, and migrating prepaid users to postpaid, Airtel can raise ARPU further while deepening customer stickiness. - Fiber-to-the-home (FTTH) expansion:

With 11M home customers and 847 towns already covered, Airtel targets 40M home passes. Broadband demand in India is exploding, and Airtel Xstream Fiber is positioned to capture high-value urban and tier-2 families. - Enterprise digital solutions:

Airtel Business can rebound by focusing on cloud, cybersecurity, CPaaS, and IoT. As Indian corporates undergo digital transformation, Airtel can lock in long-term annuity contracts beyond connectivity. - OTT and lifestyle bundling:

Airtel’s “one subscription” model with 25+ OTTs (Netflix, Sony LIV, Zee5, etc.) positions it as more than a telco. Lifestyle bundling expands average revenue per household and differentiates Airtel from price-only competitors. - Satellite broadband via OneWeb:

Bharti’s stake in OneWeb opens optionality in satellite internet. With India exploring satcom policy, Airtel could tap underserved rural markets and enterprise solutions where fiber is unviable. - Africa growth engine:

Airtel Africa delivered ~25% YoY revenue growth (CC) in Q1 FY26 with EBITDA margins above 48%. Data and mobile money adoption in Africa remain underpenetrated, giving Airtel a decade-long growth runway. - Tariff repair and ARPU hikes:

India’s wireless industry has consolidated into a duopoly (Airtel + Jio). With Vi struggling, Airtel is well placed to push tariff hikes further, creating room for sustainable ARPU growth.

🌟 Key Airtel Opportunities

- 📶 5G at scale: Monetize 135M+ users with premium pricing and postpaid migration.

- 🏠 FTTH expansion: From 847 towns to 40M+ home passes.

- 🛡️ Enterprise services: Cloud, CPaaS, IoT, and cybersecurity annuities.

- 🎬 OTT bundles: 25+ platforms with lifestyle perks.

- 🛰️ OneWeb satellite: Future-ready access to rural and enterprise markets.

These Airtel opportunities mirror how converged ecosystems create long-term moats — much like digital-first strategies we analyzed in our YouTube SEO in India guide.

Summary: Airtel’s opportunities include 5G monetization, fiber expansion, enterprise services, OTT bundles, satellite broadband, Africa scale, and tariff-led ARPU growth.

Threats to Bharti Airtel

The threats of Bharti Airtel highlight the risks that could challenge its growth, profitability, and premium positioning in India and Africa. Despite strong fundamentals, Airtel faces industry-level headwinds that demand careful navigation in 2025.

- Competitive intensity with Jio:

Reliance Jio remains the largest wireless operator with 470M+ subscribers. Its aggressive bundling of fiber, content, and apps (JioCinema, JioFiber, JioSaavn) forces Airtel to continuously invest to defend market share. - Capex and debt risks:

Telecom requires ongoing spectrum purchases, 5G rollout, and fiber expansion. Even with a relatively low debt ratio (Net debt/EBITDAaL 1.26x), prolonged heavy capex could strain free cash flow and reduce financial flexibility. - Regulatory and policy uncertainty:

Indian telecom policy is unpredictable, from AGR dues in the past to upcoming satcom rules. If subscriber caps or spectrum allocation policies turn restrictive, Airtel’s future plays in satellite broadband may be slowed. - Africa macroeconomic exposure:

Airtel Africa contributes 169M subscribers and high margins. But forex volatility, inflation, and political risks in markets like Nigeria and Kenya can swing profitability sharply. - DTH structural decline:

With OTT adoption accelerating, Airtel Digital TV revenues are stagnating at ~₹760 crore a quarter. This long-term decline eats into Airtel’s household share unless IPTV and fiber fully compensate. - Network security threats:

Recent incidents of theft and sabotage (e.g., Punjab equipment thefts in 2025) highlight physical security risks to Airtel’s network. Each disruption can impact service quality and brand trust. - ARPU ceiling pressure:

At ₹250, Airtel commands the highest ARPU in India. But India’s mass-market price sensitivity could limit further hikes, constraining growth unless premium services and bundles offset this ceiling.

🔥 Pro Tip: Airtel’s biggest risk isn’t losing subscribers — it’s failing to monetize them fast enough. Jio plays the volume game, but Airtel must keep pushing premiumization (postpaid, OTT, 5G) to avoid ARPU stagnation in a low-income market.

These Airtel threats underline the challenges of competing in a high-capex, low-ARPU market — a contrast to sectors like technology services where margins scale faster, as seen in our TCS SWOT analysis.

Summary: Airtel’s threats include Jio’s aggressive competition, heavy capex, regulatory unpredictability, Africa volatility, DTH decline, network security risks, and ARPU ceiling pressure.

Bharti Airtel: Key Metrics Snapshot 2025

| Metric | Value | Period |

|---|---|---|

| Total customers (Global) | ~605.5 million | Q1 FY26 |

| India / Africa customers | 436.1m / 169.4m | Q1 FY26 |

| Consolidated revenue | ₹49,463 crore | Q1 FY26 |

| India revenue | ₹37,585 crore | Q1 FY26 |

| India EBITDA / margin | ₹22,352 crore / 59.5% | Q1 FY26 |

| Mobile ARPU (India) | ₹250 | Q1 FY26 |

| Homes (FTTH + FWA) customers | ~11.0 million | Q1 FY26 |

| Homes net adds (record) | ~0.94 million | Q1 FY26 |

| Digital TV customers | ~15.7 million | Q1 FY26 |

| 5G users (estimate) | ~135 million | Mar 2025 |

| Xstream Fiber towns (India) | 847 towns | Q1 FY26 |

| Network expansion (Q1) | ~1.8k towers; +7.5k MBB sites | Q1 FY26 |

| Fiber added (YoY) | ~43,700 km | Q1 FY26 |

| Airtel Africa revenue growth | +24.9% (constant currency) | Q1 FY26 |

| Net debt / EBITDAaL (annualised) | ~1.26x | Q1 FY26 |

| Enterprise revenue growth | -7.7% YoY (portfolio pruning) | Q1 FY26 |

Profitability momentum (India)

High

ARPU trajectory

Strong

FTTH expansion pace

Rapid

Africa growth

Strong

Enterprise momentum

Muted

Conclusion of Bharti Airtel SWOT Analysis 2025

The Bharti Airtel SWOT analysis 2025 shows how Airtel has transformed into India’s premium telecom brand with strong profitability and global scale. With 605M+ customers, ARPU at ₹250, and India EBITDA margin of nearly 60%, Airtel is a benchmark for disciplined execution in telecom.

Strengths such as premium ARPU leadership, rapid FTTH growth, Africa diversification, and superior 5G network quality give Airtel a solid foundation. Weaknesses include heavy capex, Jio’s scale, and challenges in DTH and enterprise revenue growth.

Opportunities lie in monetizing 5G adoption, expanding home broadband, scaling digital enterprise solutions, bundling OTTs, and tapping satellite broadband via OneWeb. Threats include regulatory risks, Africa volatility, network security issues, and India’s ARPU ceiling.

As Deepak Singh, Founder of The DM School, my analysis highlights Airtel as a rare telecom operator balancing scale, profitability, and premiumization in a low-ARPU market. Its playbook offers lessons in pricing discipline and ecosystem building for marketers, strategists, and students.

For comparative insights, also see our Dmart SWOT analysis, which shows how Indian consumer companies build moats differently compared to telecom operators.

Summary: Airtel combines scale, pricing power, Africa growth, and digital bundling to sustain leadership, but must manage capex, regulation, and competition to protect margins in 2025.

Bharti Airtel SWOT – FAQs

What is Bharti Airtel?

Bharti Airtel is India’s second-largest telecom operator and one of the top global communications companies. It provides mobile services, fiber broadband, DTH/IPTV, enterprise connectivity, and data center solutions across India and Africa, serving over 605 million customers as of Q1 FY26.

What is the Bharti Airtel SWOT analysis 2025?

The Bharti Airtel SWOT analysis 2025 evaluates its strengths, weaknesses, opportunities, and threats using FY25 and Q1 FY26 performance. It highlights Airtel’s premium ARPU leadership, broadband growth, Africa diversification, and risks from regulation, competition, and capex intensity.

What are the strengths of Bharti Airtel?

Airtel strengths include ARPU of ₹250, India EBITDA margin of ~60%, strong FTTH growth with 11M broadband customers, high-margin Africa operations, 135M+ estimated 5G users, prudent debt ratio (1.26x Net debt/EBITDAaL), and differentiated OTT bundling with 25+ platforms.

What are the weaknesses of Bharti Airtel?

Airtel weaknesses are its heavy capex burden for spectrum and fiber, competitive pressure from Reliance Jio, structural decline in DTH, muted enterprise revenue (-7.7% YoY in Q1 FY26), Africa forex and regulatory exposure, and a potential ARPU ceiling in price-sensitive Indian markets.

What opportunities lie ahead for Bharti Airtel?

Airtel opportunities include monetizing 5G with postpaid migration, expanding FTTH to 40M home passes, cross-selling enterprise cloud and cybersecurity, scaling Africa’s mobile money ecosystem, and tapping satellite broadband through its OneWeb stake once policies stabilize.

What are the threats faced by Bharti Airtel?

Airtel threats include aggressive competition from Jio, high capex requirements, regulatory uncertainty in India and satcom, currency volatility in Africa, decline in DTH revenues, network security risks, and limited headroom to push ARPU beyond ₹250 in a mass market.

What was Airtel’s revenue in Q1 FY26?

Airtel revenue in Q1 FY26 was ₹49,463 crore, a 28.5% YoY increase. India revenue was ₹37,585 crore, supported by ARPU uplift, broadband additions, and tariff hikes. Africa operations grew 24.9% in constant currency with strong margins.

What is Bharti Airtel’s ARPU?

Airtel ARPU reached ₹250 in Q1 FY26, the highest in India’s telecom industry. This reflects tariff hikes in 2024, migration of prepaid to postpaid, and increasing adoption of 5G and bundled OTT services, which raise average spending per user.

How many customers does Bharti Airtel have?

Airtel customers totaled ~605.5 million in Q1 FY26, with 436.1M in India and 169.4M in Africa. This scale positions Airtel as a global telecom leader, second only to Jio in India and among the top operators worldwide by subscriber base.

What is Airtel’s market share in India broadband?

Airtel Xstream Fiber has ~11 million home broadband users with ~21.8% market share (TRAI, June 2025). Jio leads with ~31.4% share, but Airtel is rapidly expanding with a target of 40 million home passes across 2,000 towns.

What is Airtel Africa?

Airtel Africa is a subsidiary with operations in 14 African countries, serving 169M customers. In Q1 FY26, it delivered 24.9% YoY revenue growth (constant currency) with EBITDA margin of 48%. Its mobile money and data services are key growth drivers.

What is Airtel’s 5G presence?

Airtel 5G covers hundreds of Indian cities with an estimated 135M users as of Mar 2025 (Omdia). It offers unlimited 5G data on 2GB/day+ plans, winning Opensignal’s award for best 5G download speed in India (June 2025).

What is Airtel’s DTH business performance?

Airtel Digital TV serves ~15.7M customers but revenue stagnated at ₹763 crore in Q1 FY26. As Indian households migrate to OTT streaming, DTH growth is slowing, making IPTV and fiber key to household revenue replacement.

What is Airtel Business?

Airtel Business is the enterprise arm offering connectivity, CPaaS, cloud, IoT, and cybersecurity. It faced a -7.7% YoY decline in Q1 FY26 due to pruning low-margin deals but remains critical for long-term annuity revenues.

What is Airtel’s stake in OneWeb?

Bharti Airtel, through Bharti Global, holds a significant stake in Eutelsat OneWeb. As of 2025, its stake is ~17.8% post capital raise. This investment positions Airtel to tap the satellite broadband market once regulatory clarity emerges in India.

What is Airtel’s financial leverage?

Airtel’s net debt to EBITDAaL stood at ~1.26x in Q1 FY26. This conservative leverage allows Airtel to continue investing in spectrum, fiber, and 5G rollouts without overstretching its balance sheet.

What is Airtel’s dividend policy?

Airtel dividend payouts have been limited compared to cash flow needs, as most capital is reinvested into spectrum and network expansion. Investors value Airtel more for growth and ARPU premium than near-term high dividend yield.

What risks does Airtel face in Africa?

Airtel Africa risks include forex volatility, inflation, and political uncertainty. For example, currency swings in Nigeria can impact consolidated margins significantly, even though Africa operations are highly profitable operationally.

What is Airtel’s strategy for OTT bundles?

Airtel OTT strategy revolves around “one subscription” packs with 25+ platforms including Netflix, Sony LIV, and Zee5. This increases household ARPU, improves stickiness, and positions Airtel as a digital lifestyle provider beyond connectivity.

What is Airtel’s future outlook?

The future outlook of Airtel is stable but capex-heavy. Growth will come from 5G monetization, FTTH expansion, Africa mobile money, and OTT bundling. Risks include Jio’s aggressive competition, regulatory policy shifts, and ARPU ceiling in India.

Why is a SWOT analysis important for Bharti Airtel?

A Bharti Airtel SWOT analysis helps investors, students, and strategists understand its premium pricing power, operational strengths, vulnerabilities, and growth levers. It provides a structured view of Airtel’s position in India’s telecom duopoly with Jio.