Razorpay India 2025 review is here. If you’re running a startup or D2C brand, your payment gateway isn’t just a tool — it’s the backbone of your revenue flow.

I’m Deepak Singh, Founder of The DM School (Google Partner; 1 Lakh+ students). We’ve scaled multiple Indian startups where Razorpay directly influenced conversion rates and ad ROI. See our reviews here.

In this post, we’ll break down Razorpay’s fees, features, settlement times, and success rates — with an India-first lens. We’ll also compare it with other best payment gateways in India so you can decide if Razorpay fits your stack.

Unlike generic reviews, this one uses live pricing data, India-specific compliance insights, and conversion math. That means you’ll know exactly what Razorpay does well — and where it struggles.

Contents — Razorpay India 2025 Review

What is Razorpay? — Quick Answer

Razorpay is an RBI-licensed Indian payment gateway offering UPI, cards, net banking, and payouts. It powers lakhs of startups and D2C brands.

It’s not just a processor. Razorpay builds APIs, dashboards, and payout tools that help founders manage growth at scale.

Summary: Razorpay is a full-stack Indian payment gateway with UPI-first routing and RBI approval, built for startups and D2C brands.

Razorpay Fees in India 2025

Fees affect margins directly. Focus on modes your customers actually use.

Here’s the practical view for Indian startups this year.

| Mode | Indicative Fees (2025) | Notes |

|---|---|---|

| UPI (P2M) | Typically ₹0 MDR | Government-backed waiver; verify any gateway offers or caps. |

| RuPay Debit | Typically ₹0 MDR | Waiver applies in India; confirm on plan card. |

| Domestic Credit/Debit Cards | ~2% + GST | Varies by category and slab negotiations. |

| Net Banking | ~2% + GST | Bank-dependent; check issuer coverage. |

| Wallets / BNPL | ~2%–3% + GST | Higher due to partner rails and risk. |

| International Cards | ~3%–4.3% + GST | Cross-border and FX may add costs. |

Snapshot: In 2025, UPI and RuPay debit are ₹0 MDR. Cards and net banking hover near 2% plus GST.

Expect add-ons for instant settlement, chargebacks, and disputed refunds. These are separate from MDR.

Always check the live Razorpay pricing page and your checkout term length before finalising.

Summary: Lean on UPI and RuPay for low costs. Model cards at ~2% and international above 3%.

Key Razorpay Features for Startups in India (2025)

Razorpay is more than a checkout button. Its stack touches collection, payouts, and growth tools. Here are the core features.

1. UPI-First Checkout

Razorpay routes most Indian payments via UPI. It improves success rates and lowers MDR compared to cards.

2. Subscriptions & UPI AutoPay

Supports recurring billing with UPI AutoPay and cards. Useful for EdTech, SaaS, and coaching platforms.

3. Payouts & Vendor Payments

Cashfree may dominate payouts, but Razorpay offers APIs to pay vendors, tutors, and affiliates directly.

4. Payment Links & QR Codes

Startups without websites can still collect payments via links and branded UPI QR codes.

5. Smart Dashboard & APIs

Detailed reporting plus API hooks for Shopify, WooCommerce, and custom apps make integration flexible.

Pro Tip: If you run subscription models, enable UPI AutoPay. It reduces failed renewals versus cards, especially in India.

At Digital Marketing Agency in Bangalore, we’ve seen founders save lakhs by activating Razorpay AutoPay early in their funnel.

Summary: Razorpay’s edge is UPI-first routing, subscriptions, and APIs. These matter most for scaling Indian startups.

Razorpay Settlement Times Explained (India 2025)

Razorpay typically follows a T+2 settlement cycle. That means funds from successful transactions reach your account in two working days.

This works for many startups, but not all. Fast-scaling D2C and EdTech brands often need quicker cycles to reinvest in ads.

Snapshot: Razorpay = T+2. Cashfree offers T+1 or instant (extra fee). Faster settlements improve ad reinvestment and cash flow stability.

Some categories (high-risk, cross-border) may face longer holds. Instant settlement is not native on Razorpay, unlike competitors such as Cashfree.

At Digital Marketing Agency in Pitampura, we’ve seen campaigns stall because founders waited three days for cleared funds.

Summary: Razorpay uses T+2 settlements. If you need faster cash flow, evaluate Cashfree or hybrid setups.

Success Rates — UPI vs Cards on Razorpay (2025)

In India 2025, UPI dominates Razorpay transactions. Success rates hover near 99% on UPI compared to 90–95% on cards.

Every failed payment equals a lost order and wasted ad spend. For startups, even 3% difference impacts CAC sharply.

Pro Tip: For a ₹999 product, a 3% drop in success rate means ₹30,000 lost per lakh in sales volume.

Our tests at Digital Marketing Agency in Noida show UPI-first routing lowers funnel friction, stabilises ad ROI, and increases repeat payments.

Cards still matter for EMI, BNPL, and high-ticket sales. But UPI is the conversion workhorse in India 2025.

Summary: Razorpay’s UPI routing wins on success rates. Cards help EMI funnels, but expect higher failure percentages.

Pros & Cons of Razorpay India (2025)

Every gateway has strengths and trade-offs. Here’s how Razorpay stacks up in India 2025.

Our Google Partner SEO Agency clients often balance Razorpay with Cashfree or Stripe, depending on use-case.

Summary: Razorpay wins on UPI and APIs. Weaknesses are settlement speed and higher international fees.

Razorpay vs Other Gateways in India 2025

No payment gateway is perfect. The smart play is comparing Razorpay with its biggest rivals in India 2025.

| Gateway | Strengths | Weaknesses |

|---|---|---|

| Razorpay | UPI-first, subscriptions, strong APIs, RBI-approved | T+2 settlements, higher intl fees |

| Cashfree | T+1/instant settlements, strong payouts | Weaker subscription stack |

| Stripe India | SaaS billing, global cards, clean APIs | Higher fees (3–4.3%), not SME-first |

| Instamojo | Easy for small businesses, flat fee model | T+3 settlements, weaker enterprise tools |

| PayU India | Enterprise-ready, EMI/BNPL support | Average UPI routing vs Razorpay |

Our Best Payment Gateways India guide compares all providers in detail. Razorpay leads on UPI, but Cashfree and Stripe win on speed and global reach.

Summary: Razorpay dominates UPI-first startups. For faster settlements or SaaS, Cashfree and Stripe may fit better.

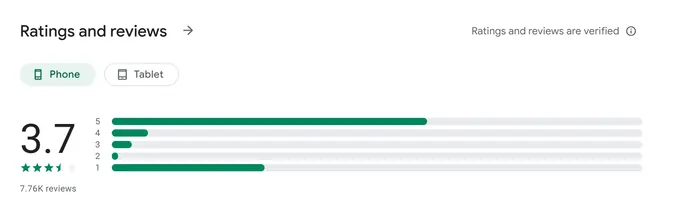

User Sentiment — Razorpay Reviews 2025

On Google Play Store, the Razorpay Business app holds a 3.7/5 rating from over 7,700 reviews.

Users praise its secure UPI checkout and feature set. But many flag concerns over support delays, account holds, and settlement disputes.

“I was looking for one stop solution for payment for my very new ed-tech startup (1stMentor), and then I found Razorpay a decent option to go with. No doubt this was one of the best choices I made at that time, as their customer service is awesome, and they are always ready to listen. I have also shared Razorpay to a lot of friends, who come for advice of starting our own business.” — Prashant Mishra, Play Store Review

This mix of 5-star trust and 1-star frustration makes Razorpay a powerful but sometimes risky choice for Indian startups.

Summary: Razorpay earns solid ratings overall, but founders must prepare for support and settlement friction.

Conclusion — Razorpay India 2025 Review

The Razorpay India 2025 review shows why it’s the go-to for UPI-first startups. It delivers high success rates, subscriptions, and solid APIs.

Weaknesses remain — T+2 settlements and higher international fees. Still, for D2C, EdTech, and SaaS founders, Razorpay is a growth ally.

Six months from now, your ad ROI will depend on how frictionless your checkout is. Don’t treat your gateway as an afterthought.

Need help deciding? Book a Free Strategy Call and we’ll map Razorpay (or alternatives) to your funnel.

Summary: Razorpay works best for India-first startups. For speed or global reach, consider Cashfree or Stripe.

FAQs — Razorpay India 2025

What are Razorpay fees in India 2025?

UPI and RuPay debit are ₹0 MDR. Cards and net banking ~2% + GST. International cards 3%–4.3% + GST.

How long does Razorpay take to settle payments?

Razorpay runs on a T+2 cycle. Funds arrive in two working days, longer for high-risk or cross-border merchants.

What is Razorpay’s success rate?

UPI success rates average 99% on Razorpay. Cards hover 90–95%, with EMI and BNPL slightly lower.

Is Razorpay safe for startups?

Yes. Razorpay is RBI-authorised as a Payment Aggregator. Funds route via nodal/escrow accounts for compliance and security.

Who should use Razorpay?

D2C brands, SaaS startups, and EdTech platforms needing UPI AutoPay are the best fit for Razorpay in India 2025.

How does Razorpay compare with Cashfree?

Razorpay wins on subscriptions and APIs. Cashfree offers faster settlements (T+1/instant) and stronger payout tools.

Does Razorpay support international cards?

Yes. Razorpay accepts Visa, Mastercard, Amex, and Diners Club cards, charging 3%–4.3% + GST on international transactions.