Cashfree India 2025 review matters because for most founders, settlement delays kill cash flow. Waiting T+2 days for money feels like running a marathon barefoot.

That’s where Cashfree positions itself differently in 2025 — promising faster settlements, smoother payouts, and competitive pricing for Indian startups and SMEs.

In this article, we’ll break down pricing, fees, payout speeds, pros & cons, and Cashfree vs Razorpay/PayU/Instamojo. By the end, you’ll know if Cashfree fits your business in 2025.

At The DM School, I’ve worked with 1 Lakh+ students and founders who faced the same challenges. I know how settlement speed impacts daily survival — and that’s why reviews like this go beyond features to what actually matters.

I’m Deepak Singh, Founder of The DM School (Google Partner; 1 Lakh+ students). We’ve helped countless founders tackle these same issues — and our reviews show the results.

Table of Contents

What is Cashfree India 2025?

Quick Answer: Cashfree is an Indian payment gateway and payouts platform for UPI, cards, netbanking, wallets, and bulk disbursals—built for faster settlements and reliable business payouts.

Cashfree India 2025 review starts with the basics. Cashfree lets Indian businesses accept payments and send payouts at scale—within apps, websites, and CRMs.

On the acceptance side, you get UPI, cards, netbanking, wallets, and subscription options. On payouts, you can disburse to bank accounts, UPI IDs, and cards.

Cashfree integrates with popular stacks and partner banks, so founders can go live quickly without rebuilding payment flows from scratch.

If you want a broader market context, compare Cashfree with top rivals in our Best Payment Gateways in India guide.

UPI is the default rail for Indian consumers. For background, see NPCI for live updates and standards.

Fact: Cashfree supports collections and payouts from a single dashboard.

Summary: Cashfree unifies collections and payouts for Indian businesses with UPI-first rails.

Why Fast Settlements Matter for Indian Businesses

Quick Answer: Faster settlements shrink cash-flow gaps, unlock ad spend, reduce refund risk, and keep UPI-first customers happy in India.

In India, working capital makes or breaks MSMEs. T+2 settlements delay inventory, salaries, and ad budgets.

When funds land same-day, you reallocate faster—into ads, stock, or payouts—without dipping into credit.

Cash flow speed is a growth lever, not a back-office detail.

UPI dominates consumer payments. Settlement delays on high-volume UPI days hit D2C brands hardest during sales.

Founders also face GST outflows and vendor terms; slow settlements widen the cash crunch.

Pro Tip: Map your daily ad spend to expected settlement receipts. Scale when receipts reliably cover tomorrow’s budgets.

Cashfree positions itself on fast settlements and streamlined payouts, which helps marketplaces and gig platforms stay liquid.

Fact: Faster settlements cut working-capital gaps and stabilize daily ad budgets.

Need a plan to align settlements with ad scaling? Book a Free Strategy Call and we’ll blueprint a cash-flow-aware growth plan.

For broader gateway comparisons, see our hub: Best Payment Gateways in India. For execution, we’re a Google Partner Digital Marketing Agency.

Summary: Faster settlements restore working capital and let Indian brands scale ads without cash-flow whiplash.

Core Features of Cashfree Payment Gateway

Snapshot: Cashfree combines collections (UPI, cards, netbanking, wallets, subscriptions) and payouts (bank, UPI IDs, cards) in one dashboard.

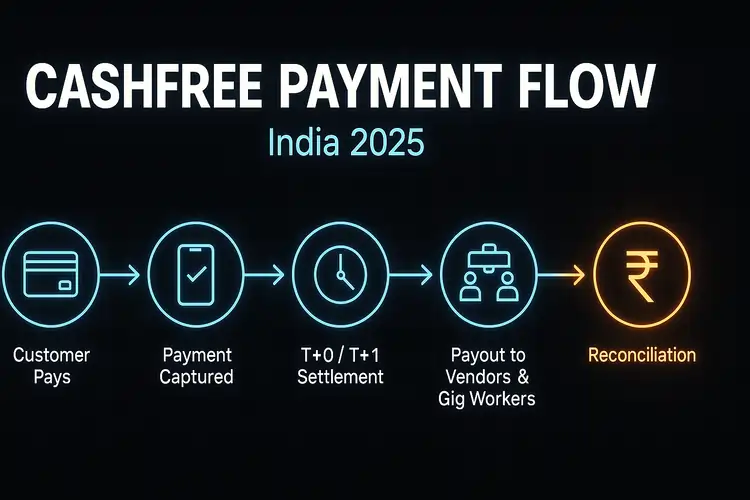

Flow Diagram: [Customer pays → Payment captured → T+0/T+1 settlement → Payout to vendors/gig workers → Reconciliation].

Cashfree focuses on speed and reliability for Indian merchants. You get modern APIs, sane onboarding, and tooling that scales with volume.

Developers plug into REST APIs, SDKs, webhooks, and plugins for popular Indian e-commerce stacks.

| Capability | What it does | Who benefits |

|---|---|---|

| UPI + Cards + Netbanking | Collect across India’s dominant rails | D2C, SaaS, education, services |

| Subscriptions / Recurring | Automate repeat billing with smart retries | SaaS, memberships, courses |

| Instant / Early Settlements | Faster access to funds on eligible plans | High-volume brands, flash sales |

| Payouts / Disbursals | Send to bank accounts and UPI IDs at scale | Marketplaces, gig platforms, lenders |

| Webhooks & Events | Real-time updates for payments and payouts | Engineering & ops automation |

| Reconciliation & Reports | Daily settlement files and ledgers | Finance & ops teams |

| Plugins / Connectors | Go live quickly on common stacks | SMBs and fast movers |

Pro Tip: Keep collections and payouts in separate bank accounts/VPAs to simplify reconciliation and audits.

Fact: Cashfree supports collections, settlements, and payouts from a single stack.

Need a setup blueprint? Start with our Ad Process, then align payment flows with your growth plan. For hands-on help, Book a Free Strategy Call.

Summary: Cashfree streamlines India-first collections, settlements, and payouts with practical APIs and reports.

Pricing & Fees Explained (2025 Update)

For most founders, pricing clarity is as critical as settlement speed. Cashfree keeps its fee structure simple, but you still need to compare it with competitors.

| Payment Mode | Cashfree Fee (2025) | Notes |

|---|---|---|

| UPI | 0% – 0.4% | Varies by volume; UPI Lite free |

| Credit Cards | 1.75% – 2% | Standard interchange rates apply |

| Debit Cards | 0.9% – 1% | RBI-regulated caps |

| Netbanking | 1.5% flat | Most Indian banks supported |

| Wallets | 2% | Paytm, PhonePe, Amazon Pay |

| Payouts | ₹3 – ₹5 per transfer | Bulk rates available for gig/marketplaces |

Hidden fees eat margins faster than refunds. Always benchmark UPI, cards, and payout costs side by side.

Fact: UPI is Cashfree’s lowest-cost rail in 2025.

For gateway comparisons, see our Razorpay India Review or the full Best Payment Gateways in India guide.

Summary: Cashfree’s 2025 pricing is competitive on UPI, average on cards, and transparent on payouts.

Cashfree vs Alternatives (Razorpay, PayU, Instamojo)

Every Indian founder asks the same question: should we choose Cashfree, Razorpay, PayU, or Instamojo? Here’s how they stack up in 2025.

| Feature | Cashfree | Razorpay | PayU | Instamojo |

|---|---|---|---|---|

| Settlement Speed | T+0 / T+1 on eligible plans | T+2 standard, early settlement add-on | T+2 standard | T+2 standard |

| UPI Costs | 0% – 0.4% | 0% – 0.3% | 0% – 0.4% | 0% – 0.5% |

| Card Fees | 1.75% – 2% | 1.75% – 2% | 1.8% – 2% | 2% |

| Payouts | ₹3 – ₹5 per transfer | ₹5 – ₹7 per transfer | ₹5 flat | No dedicated payouts |

| Integration | APIs, SDKs, plugins | APIs, SDKs, plugins | APIs, SDKs | Simplified setup, fewer APIs |

| Best Fit | Marketplaces, gig payouts, D2C | Startups, SaaS, high-volume D2C | Enterprises, NBFCs | Solopreneurs, micro-SMBs |

Unlike others, Cashfree positions itself on payouts + settlements, not just collections.

Fact: Cashfree is the only one in this set with strong payouts focus in 2025.

For detailed competitor reviews, see Razorpay India and our cluster on Best Payment Gateways. For SEO strategy comparisons, here’s why we’re a Google Partner SEO Agency.

Summary: Cashfree wins on payouts and settlement speed, Razorpay on startup adoption, PayU on enterprise, Instamojo on micro-SMBs.

How to Integrate Cashfree with Your Business

Integrating Cashfree is straightforward if you follow a structured flow. Here’s a step-by-step view that works for most Indian startups and SMBs.

- Create a Cashfree account: Sign up on Cashfree’s site with GST, PAN, and bank details.

- Complete KYC verification: Upload company docs, bank proofs, and get approval.

- Generate API keys: Access them from the Cashfree dashboard under developer settings.

- Choose integration type: REST APIs, SDKs, or prebuilt plugins for e-commerce stacks.

- Configure webhooks: Set up URLs to receive payment and settlement updates in real time.

- Test in sandbox mode: Run trial transactions before going live.

- Go live: Switch from sandbox keys to production keys after approval.

Pro Tip: Always test refunds and payouts in sandbox before production. It avoids disputes and failed reconciliations later.

Fact: Cashfree offers sandbox testing for APIs before live deployment.

Need help aligning integrations with your funnel? Use our Digital Marketing Funnel guide, or Book a Free Strategy Call for hands-on support.

Summary: Cashfree integration follows a clear path: account → KYC → APIs → webhooks → live.

Cashfree Payouts — Settlement Speeds & Options

Quick Answer: Cashfree offers T+0, T+1, and standard T+2 settlements in 2025, depending on plan and eligibility.

Cashfree’s standout feature is payouts. Merchants can settle funds on the same day (T+0), next day (T+1), or standard two-day cycle (T+2).

This flexibility helps D2C brands, gig platforms, and marketplaces handle vendor payments and ad budgets without borrowing.

Settlement speed is not a feature. It’s a survival tool for Indian founders scaling on thin margins.

Cashfree also supports bulk disbursals to bank accounts, UPI IDs, and cards. Reports are auto-generated for reconciliation.

Fact: Cashfree is one of the few Indian gateways to provide T+0 settlement options in 2025.

For context on settlement rules, check RBI’s official circulars. For comparisons, see our Razorpay India Review.

Summary: Cashfree’s payout edge lies in T+0/T+1 settlements, easing cash-flow gaps for Indian businesses.

Advantages & Limitations of Cashfree

No payment gateway is perfect. Here’s the 2025 reality of where Cashfree shines and where it lags.

Every gateway has gaps. Smart founders benchmark pros and cons before committing to scale.

Pro Tip: Match gateway to your business model. D2C = settlement speed. Marketplaces = payout flexibility. Enterprises = compliance depth.

Fact: Cashfree’s biggest edge is payouts; its weakest is enterprise traction.

For context on enterprise needs, explore our Google Partner SEO Agency insights on scaling with compliance.

Summary: Cashfree wins on settlements and payouts, but trails larger rivals on enterprise reach and brand recall.

Tools & Resources for Cashfree Users

Scaling with Cashfree is easier when you know where to find the right docs, policies, and support hubs. Here’s your shortlist.

- Cashfree Developer Docs — APIs, SDKs, and integration guides.

- Cashfree Support — ticketing, FAQs, and merchant helpdesk.

- RBI Circulars — official settlement and payment compliance updates.

- Best Payment Gateways in India — compare Cashfree with Razorpay, PayU, Instamojo.

- Book a Free Strategy Call — align your payment flows with a growth plan.

Fact: Cashfree’s developer docs are updated monthly with new API releases and compliance fixes.

Summary: Use Cashfree docs for tech, RBI for compliance, and our guides for growth context.

Checklist: Is Cashfree Right for You?

Run through this quick list. If you tick most boxes, Cashfree is likely a fit in 2025.

- You need faster settlements. T+0/T+1 access would unlock ad budgets or inventory cycles.

- You run payouts at scale. Marketplaces, gig platforms, or lender disbursals are core to your model.

- UPI is your dominant rail. Most customers pay via UPI; card volume is secondary.

- You want one stack. Collections, settlements, and payouts from a single dashboard.

- Your team is dev-light. You prefer SDKs/plugins over heavy custom builds.

- Your enterprise needs are modest. You don’t require deep legacy/enterprise features.

- You reconcile daily. You want clear reports, webhooks, and predictable settlements.

- You benchmark fees. UPI/card/payout costs remain competitive vs Razorpay/PayU.

Pro Tip: Pilot with 20% traffic for two weeks. Compare settlement speed, success rates, and support SLAs before migrating 100%.

Fact: Split-traffic pilots reveal gateway performance differences within two weeks.

Six months from now, you’ll have cleaner cash cycles if settlements and payouts are tightly mapped to ad spend.

Summary: Choose Cashfree if you need speed and payouts. Validate with a two-week split test.

FAQs on Cashfree India 2025

Is Cashfree approved by RBI?

Yes. Cashfree operates as a payment aggregator and is RBI-compliant for settlements and payouts in India.

What is the settlement time for Cashfree in 2025?

Cashfree offers T+0, T+1, and T+2 settlement options depending on merchant eligibility and plan.

Does Cashfree charge for UPI transactions?

UPI on Cashfree is free or up to 0.4% depending on volume and agreement terms.

Can Cashfree handle bulk payouts?

Yes. Cashfree supports bulk payouts to bank accounts, UPI IDs, and cards, widely used by gig and marketplace platforms.

How is Cashfree different from Razorpay?

Unlike Razorpay, Cashfree focuses heavily on fast settlements and payouts, making it stronger for marketplaces and gig models.

What is the payout fee in Cashfree?

Payouts typically cost ₹3 – ₹5 per transfer, with discounts for bulk disbursals at scale.

Is Cashfree good for small businesses?

Yes. Cashfree works well for D2C, edtech, and SMBs that need fast settlements, transparent pricing, and light integrations.

Conclusion: Should You Choose Cashfree in 2025?

Cashfree has carved its niche in India by betting on speed. T+0 and T+1 settlements change how founders run ads, pay vendors, and survive cash crunches.

If payouts are central to your model—marketplaces, gig, or D2C—Cashfree deserves a trial run. Enterprises with legacy requirements may still lean on PayU or Razorpay.

In India, the right gateway is not about logos. It’s about cash in your account tomorrow morning.

Fact: Cashfree remains one of the few RBI-compliant gateways in India with same-day settlement options in 2025.

Six months from now, you’ll thank yourself if your settlement cycles match your ad scaling pace.

Want a blueprint that ties payments to growth? Book a Free Strategy Call and we’ll align Cashfree (or its best-fit alternative) to your funnel.

Summary: Cashfree is built for founders who value settlement speed and payouts. Test it with a split run in 2025.