HDFC Bank SWOT analysis 2025 highlights the strengths, weaknesses, opportunities, and threats of India’s leading private sector bank.

HDFC Bank became a financial powerhouse after merging with HDFC Ltd in July 2023, creating unmatched scale in Indian banking.

As of June 2025, HDFC Bank reported deposits of ₹27.64 lakh crore and advances of ₹26.28 lakh crore, reflecting massive balance sheet strength.

The bank operates 9,499 branches and 21,251 ATMs across 4,153 cities, serving nearly 100 million HDFC Bank customers nationwide.

In Q1 FY26, HDFC Bank net profit stood at ₹26,994 crore, supported by strong NII and operating income growth.

Asset quality remains robust with gross NPA at 1.40% and CET1 ratio at 17.4%, underlining HDFC Bank strengths in risk management.

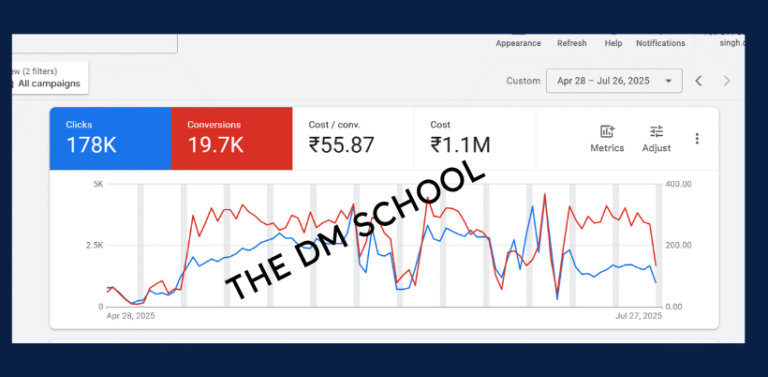

As Deepak Singh, Founder of The DM School, I present this SWOT analysis of HDFC Bank to decode its growth story and challenges.

For a sector comparison, see our Dmart SWOT analysis, contrasting retail efficiency with banking dominance.

Strengths of HDFC Bank

The strengths of HDFC Bank show why it dominates Indian private banking with scale, profitability, and trust.

Despite intense competition, HDFC Bank continues to lead due to its network, financial strength, and diversified business model.

- Massive distribution: 9,499 branches and 21,251 ATMs across 4,153 cities ensure deep penetration, especially in semi-urban and rural India.

- Large customer base: Nearly 100 million customers provide unmatched opportunities for deposits, lending, and cross-selling financial products.

- Consistent profitability: Q1 FY26 net profit ₹26,994 crore with return on assets ~1.9% and strong cost efficiency.

- Strong asset quality: Gross NPA at 1.40% reflects HDFC Bank’s disciplined risk management and robust underwriting standards.

- Capital adequacy: CET1 ratio 17.4% and overall CAR at 19.9% ensure resilience for future growth.

- Diversified subsidiaries: HDFC Life, HDFC AMC, HDFC ERGO, and HDB Financial Services strengthen non-interest income and broaden business reach.

🔥 Pro Tip: HDFC Bank’s strength is not only in size but also in discipline. Its low NPA ratio sets a benchmark for sustainable lending in India.

These HDFC Bank strengths mirror how financial consistency, like top Facebook Ads agencies in India, builds market dominance and customer trust.

Summary: HDFC Bank strengths include unmatched distribution, massive customer base, steady profitability, excellent asset quality, capital strength, and diversified subsidiaries.

Weaknesses of HDFC Bank

The weaknesses of HDFC Bank show pressure points in funding mix, profitability, and post-merger integration.

Even India’s strongest private bank faces challenges in sustaining margins and rebuilding its low-cost deposit franchise.

- Low CASA ratio: At 34% in June 2025, down from pre-merger highs, raising sensitivity to funding costs.

- NIM compression: Net interest margin fell to 3.35% in Q1 FY26, impacting profitability versus peers.

- Integration challenges: The merger with HDFC Ltd adds complexity in systems, compliance, and cultural alignment.

- High capital needs: Continuous growth requires large equity infusions and heavy reliance on capital markets.

- Retail concentration: Mortgages form ~30% of advances, creating exposure to interest rate and housing cycles.

📊 CASA Ratio Comparison (Jun 2025)

- HDFC Bank: 34%

- ICICI Bank: ~43%

- Axis Bank: ~42%

- Kotak Bank: ~48%

HDFC Bank’s CASA lag reduces cost advantage compared to private sector peers.

These HDFC Bank weaknesses resemble the scaling challenges businesses face, as discussed in our DM School strategies.

Summary: Weaknesses include low CASA, margin pressure, integration complexity, high capital intensity, and mortgage concentration risk.

Opportunities for HDFC Bank

The opportunities of HDFC Bank reflect India’s fast-growing economy, rising digital adoption, and strong demand for retail banking.

HDFC Bank can leverage its vast distribution, technology, and subsidiaries to capture multiple high-growth segments simultaneously.

These opportunities can sustain profitability and strengthen leadership over the next decade.

- Digital banking growth: India’s UPI dominance and fintech adoption allow HDFC Bank to scale mobile-first financial products.

- SME and business banking: Expanding credit lines for MSMEs and entrepreneurs drives fee income and deep client relationships.

- Cross-selling power: With HDFC Life, AMC, ERGO, and Securities, the bank can bundle loans, insurance, and investments.

- Rural banking expansion: Over half its branches in semi-urban/rural regions provide a strong platform for inclusion and growth.

- Capital leverage: CET1 of 17.4% enables bold growth strategies while maintaining stability and investor confidence.

🌟 Key Growth Drivers for HDFC Bank

- 📱 Digital dominance: UPI, mobile apps, and AI-led financial services.

- 🏢 SME expansion: Deepening relationships with small and medium businesses.

- 🌍 Rural reach: Semi-urban penetration ensures future retail customer acquisition.

These HDFC Bank opportunities highlight how diversification and technology fuel growth, much like lessons from YouTube advertising in India.

Summary: Opportunities include digital growth, SME lending, cross-selling, rural banking, and leveraging strong capital for expansion.

Threats to HDFC Bank

The threats of HDFC Bank show the external risks that can challenge its profitability and leadership position.

Even with strong balance sheets and scale, the bank is exposed to regulatory, competitive, and macroeconomic uncertainties.

These threats highlight why continuous risk management is critical for a systemically important bank.

- Regulatory scrutiny: As India’s largest private bank, HDFC Bank faces strict oversight. Even minor lapses attract penalties.

- Competition for deposits: Rising deposit rates and fintech-led banks pressure CASA growth and increase funding costs.

- Credit cost normalization: GNPA at 1.40% may rise if economic conditions weaken or unsecured lending grows faster.

- Integration risks: The merger with HDFC Ltd could still bring technology, culture, or compliance challenges.

- Global volatility: Oil prices, interest rates, and currency fluctuations indirectly impact margins and loan demand.

- Reputation risks: Customer service lapses or tech outages could damage trust in a digital-first environment.

🔥 Pro Tip: Regulatory vigilance is as important as profitability. For HDFC Bank, even small compliance errors can invite scrutiny and affect reputation.

These HDFC Bank threats mirror challenges seen in dynamic industries like YouTube SEO in India, where rules and competition change fast.

Summary: Threats include regulatory pressure, deposit competition, credit cost risks, merger integration challenges, global volatility, and reputation risks.

HDFC Bank: Key Metrics Snapshot

Use this snapshot for quick facts.

Edit numbers as results update.

| Metric | Value | Period |

|---|---|---|

| Total deposits (EOP) | ₹27.64 lakh crore | Jun 30, 2025 |

| Net advances (EOP) | ₹26.28 lakh crore | Jun 30, 2025 |

| Branches / ATMs | 9,499 / 21,251 | Jun 30, 2025 |

| Cities served | 4,153 | Jun 30, 2025 |

| Customer base | ~100 million | Jun 30, 2025 |

| Net profit (PAT) | ₹26,994 crore | Q1 FY26 |

| NIM | 3.35% | Q1 FY26 |

| Gross NPA | 1.40% | Q1 FY26 |

| CET1 / Total CAR | 17.4% / 19.9% | Jun 30, 2025 |

| CASA ratio | 34% | Jun 30, 2025 |

Profitability momentum

High

Asset quality

Strong

Capital adequacy

Strong

Distribution reach

High

CASA momentum

Rebuild

Conclusion of HDFC Bank SWOT Analysis 2025

The SWOT analysis of HDFC Bank highlights why it remains India’s most influential private sector bank.

Strengths like distribution reach, strong profitability, and excellent asset quality continue to power growth and investor trust.

Weaknesses such as low CASA ratio, NIM compression, and post-merger integration risks show the limits of rapid expansion.

Opportunities in digital banking, SME lending, rural penetration, and cross-selling create a strong runway for long-term growth.

Threats from regulatory scrutiny, deposit competition, and global volatility remind us that scale always brings complexity.

As Deepak Singh, Founder of The DM School, I see HDFC Bank as a case study in balancing resilience with expansion. Businesses can learn from its ability to sustain leadership while navigating constant change.

For more insights into business strategy and growth, explore our YouTube SEO in India guide, showing how digital visibility drives scale like banking reach.

Summary: HDFC Bank remains India’s strongest private bank, balancing massive opportunities with challenges in funding and regulation.

HDFC Bank SWOT – FAQs

What is HDFC Bank?

HDFC Bank is India’s largest private sector bank, offering retail banking, wholesale banking, and treasury services nationwide.

When did HDFC Bank merge with HDFC Ltd?

The merger of HDFC Ltd into HDFC Bank became effective on July 1, 2023, creating India’s largest universal bank.

What are the strengths of HDFC Bank?

Strengths include vast distribution, strong profitability, excellent asset quality, diversified subsidiaries, and a customer base of ~100 million.

What are the weaknesses of HDFC Bank?

Weaknesses include low CASA ratio, NIM compression, high capital needs, and integration risks post-merger with HDFC Ltd.

What are the opportunities for HDFC Bank?

Opportunities include digital banking growth, SME lending, rural banking, cross-selling financial products, and leveraging strong capital strength.

What are the threats to HDFC Bank?

Threats include regulatory scrutiny, deposit competition, credit cost risks, global volatility, and reputation risks in digital banking.

What is the asset base of HDFC Bank?

As of June 2025, HDFC Bank reported total assets of ₹39.54 lakh crore, making it India’s largest private lender.

What is the deposit base of HDFC Bank?

Total deposits stood at ₹27.64 lakh crore in June 2025, with a CASA ratio of 34%.

What is the loan book of HDFC Bank?

Net advances were ₹26.28 lakh crore as of June 2025, with mortgages forming ~30% of the portfolio.

What is the net profit of HDFC Bank?

HDFC Bank posted a net profit of ₹26,994 crore in Q1 FY26, maintaining steady growth in earnings.

What is HDFC Bank’s NIM?

Net interest margin (NIM) was 3.35% in Q1 FY26, reflecting funding mix and CASA pressure.

What is the NPA ratio of HDFC Bank?

Gross NPA stood at 1.40% in Q1 FY26, among the lowest in the Indian banking sector.

How many customers does HDFC Bank have?

HDFC Bank serves nearly 100 million customers across retail, SME, corporate, and digital banking segments.

How many branches does HDFC Bank have?

The bank operates 9,499 branches and 21,251 ATMs across 4,153 cities in India.

What are the key subsidiaries of HDFC Bank?

Subsidiaries include HDFC Life, HDFC AMC, HDFC ERGO, HDB Financial Services, and HDFC Securities.

Does HDFC Bank pay dividends?

Yes. HDFC Bank pays dividends regularly. In FY25, it announced both a bonus issue and a special dividend.

What is HDFC Bank’s capital adequacy ratio?

Capital adequacy stood at 19.9% in June 2025, with CET1 ratio at 17.4%.

What is the CASA ratio of HDFC Bank?

CASA ratio was 34% in June 2025, lower than peers, but improving quarter by quarter.

What are HDFC Bank’s digital banking initiatives?

The bank invests in UPI, mobile apps, AI-based services, and partnerships with fintechs to grow digital adoption.

How is HDFC Bank expanding in SME banking?

HDFC Bank is deepening SME and business banking with credit lines, supply-chain finance, and advisory services.

What is the future outlook for HDFC Bank?

The outlook remains strong, driven by digital growth, rural banking, SME expansion, and cross-selling synergies.

Why is a SWOT analysis important for HDFC Bank?

It simplifies complex financial data into strengths, weaknesses, opportunities, and threats, helping investors and analysts make decisions.